Weld County Vehicle Tax Rate . the weld county, colorado sales tax is 2.90% , consisting of 2.90% colorado state sales tax and 0.00% weld county local. Click for sales tax rates, weld county sales tax calculator, and printable. while many counties do levy a countywide sales tax, weld county does not. the state vehicle sales tax rate in colorado is 2.9%, but counties and cities can charge local taxes. On average, you can expect to pay 6.31% sales tax unless you qualify for an exemption. the current sales tax rate in weld county, co is 9.06%. since the taxes and fees will vary for each coloradan based on the vehicle and county of residence, residents should visit their. estimate taxes on new property or change of classification of property. The colorado sales tax of 2.9% applies.

from dxobtaazx.blob.core.windows.net

On average, you can expect to pay 6.31% sales tax unless you qualify for an exemption. while many counties do levy a countywide sales tax, weld county does not. Click for sales tax rates, weld county sales tax calculator, and printable. The colorado sales tax of 2.9% applies. the current sales tax rate in weld county, co is 9.06%. since the taxes and fees will vary for each coloradan based on the vehicle and county of residence, residents should visit their. the state vehicle sales tax rate in colorado is 2.9%, but counties and cities can charge local taxes. the weld county, colorado sales tax is 2.90% , consisting of 2.90% colorado state sales tax and 0.00% weld county local. estimate taxes on new property or change of classification of property.

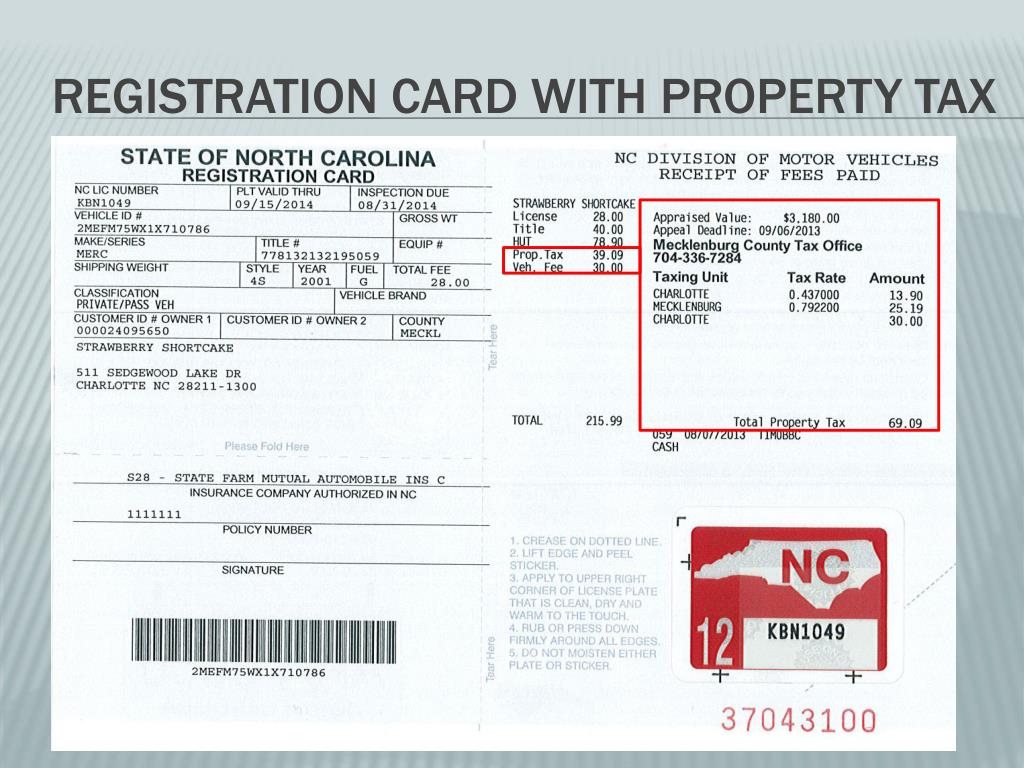

How Is Vehicle Property Tax Calculated In Nc at Joan Pattison blog

Weld County Vehicle Tax Rate estimate taxes on new property or change of classification of property. while many counties do levy a countywide sales tax, weld county does not. the state vehicle sales tax rate in colorado is 2.9%, but counties and cities can charge local taxes. estimate taxes on new property or change of classification of property. the current sales tax rate in weld county, co is 9.06%. since the taxes and fees will vary for each coloradan based on the vehicle and county of residence, residents should visit their. the weld county, colorado sales tax is 2.90% , consisting of 2.90% colorado state sales tax and 0.00% weld county local. On average, you can expect to pay 6.31% sales tax unless you qualify for an exemption. Click for sales tax rates, weld county sales tax calculator, and printable. The colorado sales tax of 2.9% applies.

From dxoixqreb.blob.core.windows.net

Sales Tax On Used Car In Arizona at Julian Sheets blog Weld County Vehicle Tax Rate while many counties do levy a countywide sales tax, weld county does not. On average, you can expect to pay 6.31% sales tax unless you qualify for an exemption. the current sales tax rate in weld county, co is 9.06%. estimate taxes on new property or change of classification of property. the state vehicle sales tax. Weld County Vehicle Tax Rate.

From mavink.com

Weld County Map Weld County Vehicle Tax Rate since the taxes and fees will vary for each coloradan based on the vehicle and county of residence, residents should visit their. The colorado sales tax of 2.9% applies. On average, you can expect to pay 6.31% sales tax unless you qualify for an exemption. while many counties do levy a countywide sales tax, weld county does not.. Weld County Vehicle Tax Rate.

From greenwoodco.corebtpay.com

Vehicle Taxes / Greenwood County, SC Weld County Vehicle Tax Rate since the taxes and fees will vary for each coloradan based on the vehicle and county of residence, residents should visit their. Click for sales tax rates, weld county sales tax calculator, and printable. the current sales tax rate in weld county, co is 9.06%. estimate taxes on new property or change of classification of property. . Weld County Vehicle Tax Rate.

From mceeonline.com

Weld County CO Royalty Interests (Smaller Decimal) MidContinent Energy Exchange Weld County Vehicle Tax Rate since the taxes and fees will vary for each coloradan based on the vehicle and county of residence, residents should visit their. the state vehicle sales tax rate in colorado is 2.9%, but counties and cities can charge local taxes. the current sales tax rate in weld county, co is 9.06%. while many counties do levy. Weld County Vehicle Tax Rate.

From propertyreport.weld.gov

Property Report Weld County Vehicle Tax Rate the current sales tax rate in weld county, co is 9.06%. the state vehicle sales tax rate in colorado is 2.9%, but counties and cities can charge local taxes. estimate taxes on new property or change of classification of property. On average, you can expect to pay 6.31% sales tax unless you qualify for an exemption. Click. Weld County Vehicle Tax Rate.

From dokumen.tips

(PDF) Figure 24 Functional Classification Map Weld County County Functional Classification Weld County Vehicle Tax Rate since the taxes and fees will vary for each coloradan based on the vehicle and county of residence, residents should visit their. On average, you can expect to pay 6.31% sales tax unless you qualify for an exemption. The colorado sales tax of 2.9% applies. the weld county, colorado sales tax is 2.90% , consisting of 2.90% colorado. Weld County Vehicle Tax Rate.

From www.neilsberg.com

Weld County, CO Median Household By Race 2024 Update Neilsberg Weld County Vehicle Tax Rate estimate taxes on new property or change of classification of property. while many counties do levy a countywide sales tax, weld county does not. the state vehicle sales tax rate in colorado is 2.9%, but counties and cities can charge local taxes. Click for sales tax rates, weld county sales tax calculator, and printable. The colorado sales. Weld County Vehicle Tax Rate.

From www.weld.gov

Community Corrections Weld County Weld County Vehicle Tax Rate since the taxes and fees will vary for each coloradan based on the vehicle and county of residence, residents should visit their. while many counties do levy a countywide sales tax, weld county does not. On average, you can expect to pay 6.31% sales tax unless you qualify for an exemption. the weld county, colorado sales tax. Weld County Vehicle Tax Rate.

From www.templateroller.com

Weld County, Colorado Motor Vehicle Bill of Sale Fill Out, Sign Online and Download PDF Weld County Vehicle Tax Rate Click for sales tax rates, weld county sales tax calculator, and printable. the weld county, colorado sales tax is 2.90% , consisting of 2.90% colorado state sales tax and 0.00% weld county local. The colorado sales tax of 2.9% applies. since the taxes and fees will vary for each coloradan based on the vehicle and county of residence,. Weld County Vehicle Tax Rate.

From www.weld.gov

Weld County Road 74 ACP Weld County Weld County Vehicle Tax Rate the current sales tax rate in weld county, co is 9.06%. since the taxes and fees will vary for each coloradan based on the vehicle and county of residence, residents should visit their. while many counties do levy a countywide sales tax, weld county does not. estimate taxes on new property or change of classification of. Weld County Vehicle Tax Rate.

From www.weld.gov

Emergency Notifications Weld County Weld County Vehicle Tax Rate the state vehicle sales tax rate in colorado is 2.9%, but counties and cities can charge local taxes. estimate taxes on new property or change of classification of property. The colorado sales tax of 2.9% applies. while many counties do levy a countywide sales tax, weld county does not. the weld county, colorado sales tax is. Weld County Vehicle Tax Rate.

From www.weld.gov

Weld County Releases More CountySpecific COVID19 Data Weld County Weld County Vehicle Tax Rate the weld county, colorado sales tax is 2.90% , consisting of 2.90% colorado state sales tax and 0.00% weld county local. the current sales tax rate in weld county, co is 9.06%. while many counties do levy a countywide sales tax, weld county does not. the state vehicle sales tax rate in colorado is 2.9%, but. Weld County Vehicle Tax Rate.

From www.weld.gov

Engineering Criteria Manual Weld County Weld County Vehicle Tax Rate since the taxes and fees will vary for each coloradan based on the vehicle and county of residence, residents should visit their. the weld county, colorado sales tax is 2.90% , consisting of 2.90% colorado state sales tax and 0.00% weld county local. the current sales tax rate in weld county, co is 9.06%. estimate taxes. Weld County Vehicle Tax Rate.

From www.weldcountydems.org

Weld County Precinct Map Weld County Democrats Weld County Vehicle Tax Rate while many counties do levy a countywide sales tax, weld county does not. the weld county, colorado sales tax is 2.90% , consisting of 2.90% colorado state sales tax and 0.00% weld county local. estimate taxes on new property or change of classification of property. On average, you can expect to pay 6.31% sales tax unless you. Weld County Vehicle Tax Rate.

From propertyreport.weld.gov

Property Report Weld County Vehicle Tax Rate The colorado sales tax of 2.9% applies. the current sales tax rate in weld county, co is 9.06%. On average, you can expect to pay 6.31% sales tax unless you qualify for an exemption. the state vehicle sales tax rate in colorado is 2.9%, but counties and cities can charge local taxes. estimate taxes on new property. Weld County Vehicle Tax Rate.

From sebastianhoward.pages.dev

2025 Vehicle Tax Rates Sebastian Howard Weld County Vehicle Tax Rate estimate taxes on new property or change of classification of property. since the taxes and fees will vary for each coloradan based on the vehicle and county of residence, residents should visit their. On average, you can expect to pay 6.31% sales tax unless you qualify for an exemption. the state vehicle sales tax rate in colorado. Weld County Vehicle Tax Rate.

From mungfali.com

Weld County Map Weld County Vehicle Tax Rate On average, you can expect to pay 6.31% sales tax unless you qualify for an exemption. The colorado sales tax of 2.9% applies. Click for sales tax rates, weld county sales tax calculator, and printable. since the taxes and fees will vary for each coloradan based on the vehicle and county of residence, residents should visit their. while. Weld County Vehicle Tax Rate.

From www.cpr.org

Hundreds Of Weld County Oil And Gas Wells Could Be Affected By EPA’s New Map Of Air Quality Weld County Vehicle Tax Rate estimate taxes on new property or change of classification of property. since the taxes and fees will vary for each coloradan based on the vehicle and county of residence, residents should visit their. while many counties do levy a countywide sales tax, weld county does not. Click for sales tax rates, weld county sales tax calculator, and. Weld County Vehicle Tax Rate.